Assume that the Delta company needs to use 18,000 meters of copper coil during the year 2023 but the company missing an irs form 1099 for your taxes keep quiet, don’t ask experiences a shortage of it and, therefore, must liquidate much of its old copper coil inventory.

Criticisms of LIFO Accounting

- We use this method to calculate the cost of inventory sold and the valuation of the remaining stock.

- The impact of LIFO Liquidation might not be hurtful on the business operations.

- As early as 1988 the lower courts of New York had held that the Liquidation Bureau was not a state agency and therefore not subject to the Freedom of Information Act.

- The process of selling the older merchandise stock or issuing older raw material inventory to the manufacturing department is called LIFO Liquidation.

- A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

- A LIFO liquidation occurs when the amount of units sold exceeds the number of replacement units added to stock, thereby thinning the number of cost layers in the LIFO database.

The impact of LIFO Liquidation might not be hurtful on the business operations. But, it has an impactful consequence on the financial statements indeed. You might have seen something while going through any company’s financial statements. But at the same time, there are some consequences a business organization has to accept as a result. The net income in the LIFO method is lower as the latest inventory has a higher cost.

Great! The Financial Professional Will Get Back To You Soon.

The effect of this was to increase net income by approximately $1,772,000 or $0.31 per share, including $1,443,000 or $0.25 per share in the fourth quarter. When materials are returned from the factory to the storeroom, they should be treated as the most recent stock on hand. The remaining 7 lac of the units will be taken from year 3 and year 2. It is known as LIFO Liquidation, where the last in stock is first out, followed by the next layer based on the requirement. Specific goods pooled LIFO approach is not a perfect solution of LIFO liquidation but can eliminate the disadvantages of traditional LIFO inventory system to some extent.

Please Sign in to set this content as a favorite.

Thus when the State Comptroller sought to audit the activities of the Liquidation Bureau and issue subpoenas to Liquidation Bureau personnel, the lower court quashed the subpoenas under the Con Ed line of cases. Serio v. Hevesi, 2007 NY Slip Op (App. Div., 1st Dept., March 6, 2007). The decision can be obtained from the New York Unified Court System web site at /decisions, or by contacting me at The current administration has made a lot of noise about reforming the bureau and making it more “transparent.” It is doing this, however, by making the bureau even more permanent contrary to the mandate of Article 74 and the statutory receivership scheme. The FIFO method of evaluating inventory is where the goods or services produced first are the goods or services sold first, or disposed of first. The LIFO method of evaluating inventory is when the goods or services produced last are the ones to be sold or disposed of first.

Written by True Tamplin, BSc, CEPF®

A is incorrect because a decline in the LIFO reserve from the prior period may indeed indicate that LIFO liquidation has occurred. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Finance Strategists has an advertising relationship with some of the companies included on this website.

It might be tempting for the reason of understating income and tax evasions. But it is not a best practice under the ethical norms of doing business. Any business stating about LIFO Liquidation in SEC filing will have higher net income due to lower COGS. The process of selling the older merchandise stock or issuing older raw material inventory to the manufacturing department is called LIFO Liquidation. The calculation of profits from pure LIFO liquidation techniques may be misleading towards actual income calculation. While LIFO liquidation, inventory may be segregated and pooled together with similar other items (forming groups of items) for better and more realistic calculation.

In effect, a firm is apt to sell units that may have 2000 or 2010 costs attached to them. The result is a lower cost of goods sold, higher gross margin, and higher taxes. We can see that the cost of goods sold decrease $ 4,000 after the purchasing price decrease, and it will increase the profit significantly. We can see that the cost of goods sold increase $ 4,000 just after the purchasing price increase, and it will decrease the profit significantly. LIFO Reserve refers to the difference between the inventory under the LIFO method and the inventory calculated using other methods.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

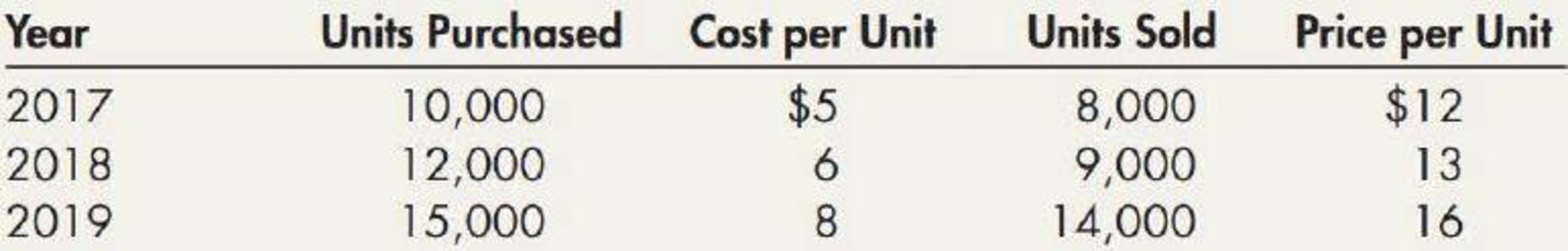

The per-unit cost is $10 in year one, $12 in year two, and $14 in year three, and ABC sells each unit for $50. It sold 500,000 units of the product in each of the first three years, leaving a total of 1.5 million units on hand. Assuming that demand will remain constant, it only purchases 500,000 units in year four at $15 per unit. For example, when using the LIFO method for inventory accounting in periods of rising prices, the cost of reported inventory is higher than the FIFO method, which, therefore, increases a company’s cost of goods sold (COGS), decreasing its pre-tax earnings.