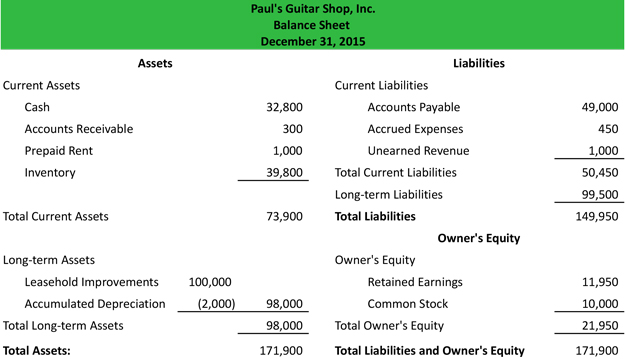

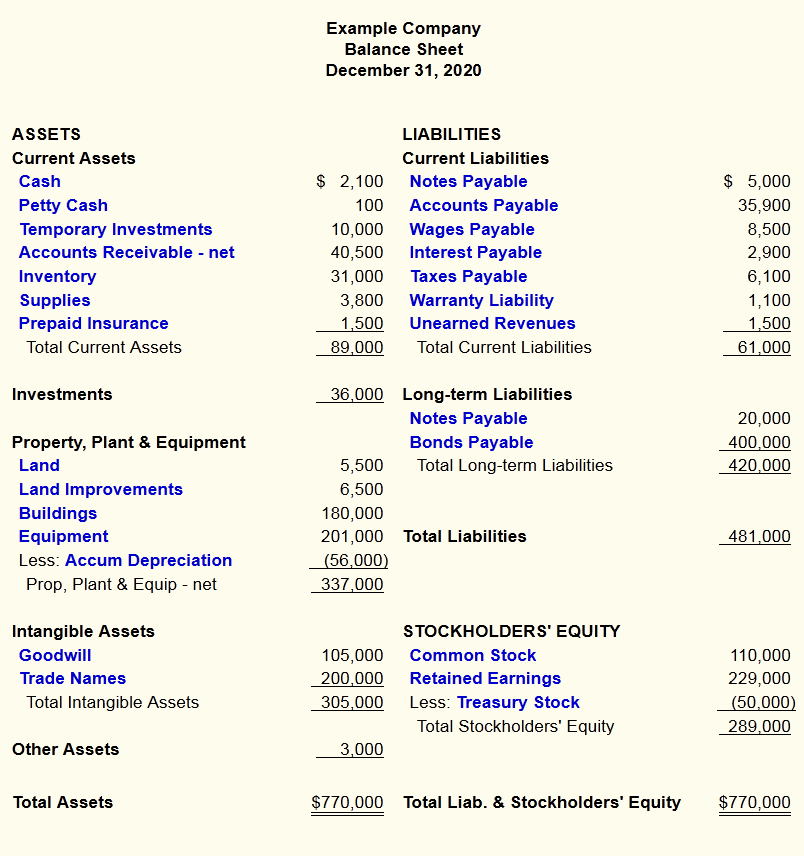

The term balance sheet refers to a financial statement that reports a company’s assets, liabilities, and shareholder equity at a specific point in time. Balance sheets provide the basis for computing rates of return for investors and evaluating a company’s capital structure. A balance sheet is one of the financial statements of a business that shows its financial position. The report can be used by business owners, investors, creditors, and shareholders. A business can prepare the balance sheet in several ways, but accounting software is the easiest. A business owner, bookkeeper, or accountant usually prepares the balance sheet.

Resources

Retained earnings is the sum of all the years of net income the company has earned over time, over and above dividends it has paid out. So, while they can’t explain commercial trends, you can compare balance sheets to measure growth over time. When the balance sheet is prepared, the liabilities section is presented first and the owners’ equity section is presented later.

Current Liabilities

Similarly, liabilities are listed in the order of their priority for payment. In financial reporting, the terms “current” and “non-current” are synonymous with the terms “short-term” and “long-term,” respectively, and are used interchangeably. Generally, sales growth, whether rapid or slow, dictates a larger asset base—higher levels of inventory, receivables, and fixed assets (plant, property, and equipment, or PPE).

Balance Sheets Examine Risk

To measure the money remaining in the company’s coffers after financing its activity. The resources are ordered according to whether or not they are due and payable. It is worth looking into if you are not already using software, as it can save time and money. When most of us think of the stock market, we think of common shares that are actively traded on exchanges. But there’s another type—preferred stock—that acts more like a bond.

The column furthest from the words will contain theoldest amounts. The older amounts provide a reference point from which sales and use tax to make comparisons. As you can see, the report form is more conducive to reporting an additional column(s) of amounts.

If the company takes $8,000 from investors, its assets will increase by that amount, as will its shareholder equity. All revenues the company generates in excess of its expenses will go into the shareholder equity account. These revenues will be balanced on the assets side, appearing as cash, investments, inventory, or other assets. Current assets refer to assets that a company can easily convert into cash within a financial year. This category includes readily available funds in the bank, inventory stock, and accounts receivable, which is money owed to the company by its customers. These assets are crucial for ensuring a company’s liquidity and its ability to meet short-term obligations.

- However, if industry standards show an asset turnover ratio of 4.0, Company C may need to enhance operational efficiency or increase sales to match industry performance.

- Maintaining a simple balance sheet is a smart way to track your company as it expands.

- If you are new to HBS Online, you will be required to set up an account before starting an application for the program of your choice.

- If you are new to HBS Online, you will be required to set up an account before enrolling in the program of your choice.

Maybe he’s got shelves full of books that have been gathering dust for years. If he can sell them off to another bookseller as a lot, maybe he can raise the $10,000 cash to become more financially stable. Long-term assets (or non-current assets), on the other hand, are things you don’t plan to convert to cash within a year. Some financial ratios need data and information from the balance sheet. Noncurrent assets are long-term investments that the company does not expect to convert into cash within a year or have a lifespan of more than one year.

We have a free template download if you want to produce one using a spreadsheet. Many different financial ratios can be calculated from the information on a balance sheet. If you want to see more examples of balance sheets, look at the Companies House website. All Limited companies must submit a Balance Sheet each year, which is available to view. For larger companies, they may even have the report on their website.

On closer inspection, these forms work with balance sheet software to gauge overall financial performance. To help you, we’ll explain what goes on a balance sheet and how to leverage balance sheets for growth. At the very bottom of the balance sheet, you will see totals for assets and liabilities plus equity. Verifying that these numbers match allows you to confirm that the data in your balance sheet is correct. It’s important to understand current vs. non-current liabilities because they affect your business differently and are listed separately on the balance sheet.