Each type of transaction has its own benefits and drawbacks that must be considered when making a decision. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. Having accurate sales data is essential for creating realistic budgets and forecasts. Otherwise, you risk overestimating or underestimating your revenue and expenses. When the fiscal year comes to a conclusion, Jimmy Electronics will pass access for bad debt. Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Desktop.

- The credit terms of purchases are usually indicated on the invoice of the purchase.

- If the sale is not paid for, the journal entry remains on the customer’s account until it is paid off.

- Each type of transaction has its own benefits and drawbacks that must be considered when making a decision.

- The sales journal records all credit transactions involving the firm’s products.

Double Entry Bookkeeping

Credit sales provide the seller with easier access to their funds, but they must wait for the customer to make payment. Hence before extending credit to customers, the companies outline the terms of the credit on their invoice. This is done so that the customer that is making the purchase will have a clear knowledge of the conditions upon which the credit has been extended to them. The data in your sales journal can give you valuable insights into your business’s performance. For example, if you see that sales are slow during certain months or times of day, you can take steps to address the issue. Assumed to be $1,000 in the example above is the basic value of the products.

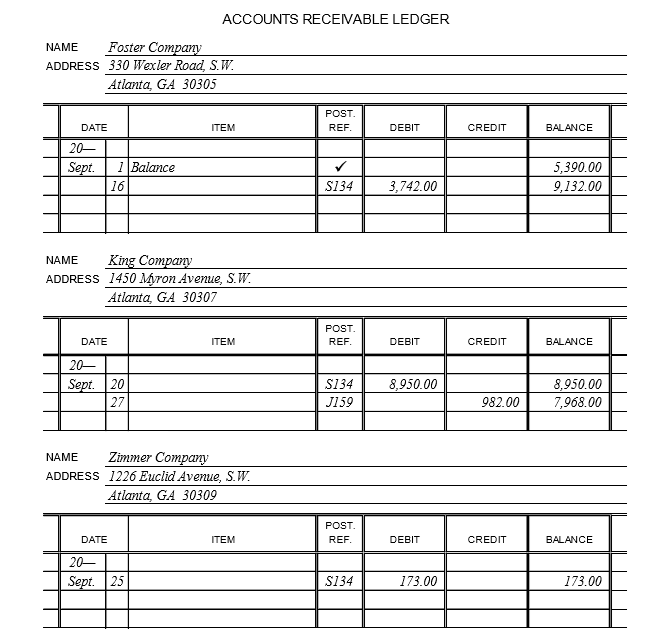

Net Accounts Receivable

It is important to note that the company is not yet entitled to cash from the customer, but is instead extending the terms of payment. It is a common form of financing in business and is often used to facilitate sales that would not otherwise be made. Credit sale can be beneficial for both the buyer and the seller, but it also carries certain risks and requires credit sales journal entry careful management. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own.

Purchase Stationery Journal Entry

It further aids the company management in making the right operational decisions, aids in budgeting, forecasting, and future planning of the company’s finances. The journal entry for sales made on credit is usually recorded once the customer has purchased the good or service irrespective of when they pay for the goods or services. This is done based on the accrual accounting method where revenue is recorded once it is earned and not when it is paid. Hence companies need to keep tabs on their accounts receivable, ensuring that the details recorded are correct. Therefore, it leads to the asset creation of the company and is shown in company’s balance sheet unless settled.

Disadvantages of Credit Sales in Financial Statements

He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy. On January 1, 2018, Company A sold computers and laptops to John on credit. On January 30, 2018, John made the full payment of $10,000 for the computers and laptops.

How To Record a Credit Sale

The journal entry includes the name of the customer, the amount of the sale, and the date of the sale. When the customer pays for the sale, the journal entry is reversed, and the customer’s account is credited. If the sale is not paid for, the journal entry remains on the customer’s account until it is paid off. Sales credit journal entries are an important part of keeping track of sales and Accounts Receivable. When the company sells any merchandise to a third party on credit, a sales credit journal entry is made and is kept in the company’s sales journal. In this scenario, the credit to the sales account is equal to the debit to the debtor’s account or account receivable account.

It denotes that sales discounts, cash discounts, and trade discounts are not included in the value of sales recorded in the income statement. Let’s talk about the benefits of businesses postponing their cash flow through credit sales and how journal entries support their ability to keep track of the quantity of receivables. When the buyer of the products accepts the goods on credit, the sales account will be credited to the business’s books of accounts.

A sales journal entry is a journal entry in the sales journal to record a credit sale of inventory. All of the cash sales of inventory are recorded in the cash receipts journal and all non-inventory sales are recorded in the general journal. In recording the journal entry of a credit sale, the entry should be made within the same accounting period in which the sale is made. This is important to ensure that the company’s financial statements accurately reflect the sales made during the period. Additionally, the journal entry should include any applicable sales taxes as well as discounts or other adjustments.

While the process may seem daunting at first, with a little practice it will become second nature. Second, the inventory has to be removed from the inventory account and the cost of the inventory needs to be recorded. So a typical sales journal entry debits the accounts receivable account for the sale price and credits revenue account for the sales price. Cost of goods sold is debited for the price the company paid for the inventory and the inventory account is credited for the same price. A credit sale journal entry is an accounting transaction used to record the sale of goods or services on credit.